Effective deal sourcing strategies serve as the bedrock of success for any thriving private equity firm. Historically, firms relied on traditional methods, prioritizing investor networking and relationship-building.

However, with the evolution of data and technology, the emergence of deal origination platforms has revolutionized the landscape, enabling firms to adopt a structured, predictable, and proactive approach to deal discovery and closure. In this article, we delve into leveraging the latest deal sourcing strategies to uncover lucrative private equity deals.

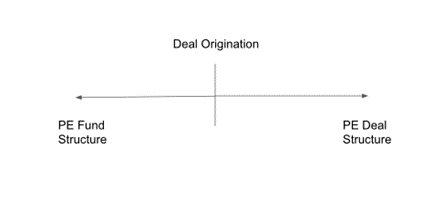

Before we dive in, it's important to understand where exactly deal origination sits within the larger, end-to-end dealmaking process. A private equity fund must be established before sourcing can start. Private equity fund structure involves General Partners acting on behalf of the private equity firm to establish an investment thesis, define investment terms, and secure capital from Limited Partners or investors.

Once fundraising is complete, deal structuring can begin. Deal origination or sourcing is the first step in this often lengthy process, which has twelve total phases, the last of which is actually signing a deal. In fact, one industry veteran estimates that just 1% of evaluated deals actually close, with the entire process taking up to a full year!

How do private equity firms find companies to buy? On the surface, it's a relatively straightforward process by which firms:

While deal sourcing in private equity may seem simple on paper, in practice, it's anything but. In his famous 2010 Equity Study, "Where Are the Deals?" David Teten shares that the average investor in a private equity firm will review at least 80 investment opportunities to make just a single investment.

PE firms must be resourceful and cast very wide nets to generate as many investment opportunities as possible. Depending solely on relationships and intermediary interest isn't enough in today's highly competitive market.

That's why leading firms are expanding their deal sourcing efforts and taking a more modern approach. Let's dive into how these dealmakers harness data, technology, people, and process to take a more proactive, agile, and streamlined approach to finding and closing deals.

A sample of the top 10% of equity firms reveals that they pay special attention to outbound deal origination. They do this by hiring at least .75 and 1.25 dedicated deal sourcers for every investment professional on the team. Alpine Investors' Director of Business Development Ajeet Gautam agrees, "I'm hard-pressed to find a PE firm out there that doesn't have some form of BD [function] these days."

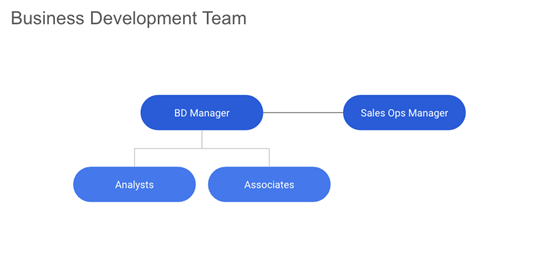

It makes sense to hire a Business Development (BD) Manager to oversee analysts and associates or researchers and their day-to-day sourcing activities. This person will be responsible for developing processes for these sourcers to follow such as what exact information to enter into the team's CRM and how often to help standardize efficiencies and ensure quality deal flow.

The BD team should also include a Sales Operations (Ops) Manager. This person works closely with your BD Manager and uses data and operational best practices to streamline deal flows, establish sales territories and quotas, identify and scale top-performing outreach tactics, and more.

More firms are choosing to focus on specific industries. One of the first steps is to identify, research, and segment all of the companies within a given space. This process is called market mapping.

Market mapping enables firms to understand the landscape, justify an investment, and then narrow their focus to specific targets. It empowers your firm to develop deep domain knowledge and expertise before pursuing a company, which ultimately sets you apart from other dealmakers in today's highly competitive market.

Firms with consistently high deal flow - such as TA Associates, which is committing to more than $3 billion in new investments each year - use data to be more scientific about their sourcing initiatives. One way to do this is by actively looking for companies that are sending up "deal signals," or data points that your firm has determined indicate investment readiness or interest.

One example of a deal signal is if a company hires a new CFO. Another may be if they are ramping up conference attendance. Paying attention to deal signals like these allows firms to proactively seek our firms that are both attractive to investors and likely to welcome outside capital.

In addition to deal signals that indicate investment readiness, top firms seek key data points about opportunities to determine whether or not they are a good fit for their current investment thesis or sector-specific strategy. These data points range from industry to ownership to website traffic to current job postings.

Developing lead scoring models around these data points is a great way to quickly identify whether or not a particular opportunity is worth pursuing. It helps your BD team prioritize its outreach and spend their time and effort where it matters most.

Doing research, mapping markets, and scoring companies is extremely time-consuming and tedious when done manually. Many founder-owned, non-transacted companies are difficult to find in the first place, let alone understand and reach.

Fortunately, data and technology are streamlining these processes through tools like CRM and private equity deal sourcing platforms like Sourcescrub. These tools help firms:

The best firms build fully-integrated tech stacks where these tools are able to seamlessly pass information back and forth between one another, improving efficiencies and streamlining private equity deal sourcing.

Once you've identified a prime investment target, you need to act before another firm does. Connecting with companies early in their lifecycles, building rapport, and staying top of mind is the ticket. Maintaining a consistent dialogue helps your prospect feel valued and illustrates your continued interest in getting a business deal done.

Take advantage of compelling events like trade shows a company attends or great new hires they make to reach out and connect. If you are able to reference specific data points on the business in your outreach, you are more likely to receive a response as it will appear more thoughtful and intentional.

Deal sourcing stands as a pivotal determinant of a private equity firm's success. In today's fiercely competitive market landscape, relying on outdated methods proves insufficient. Forward-looking enterprises must embrace cutting-edge data and technology-driven investment tactics to bolster their lead generation efforts.

Revamping your deal sourcing strategy is a gradual process that requires dedication and strategic evolution. Most firms undergo a discernible maturation journey, marked by incremental advancements in people, processes, and technology. Eager to assess your firm's position and discover the essential steps needed to progress? Check out our comprehensive 4-stage deal sourcing maturity model guide to kick-start your transformation journey today!

Originally posted on “March 21, 2023”